Beyond Purchase Price – Rethinking Medical Equipment as an Investment

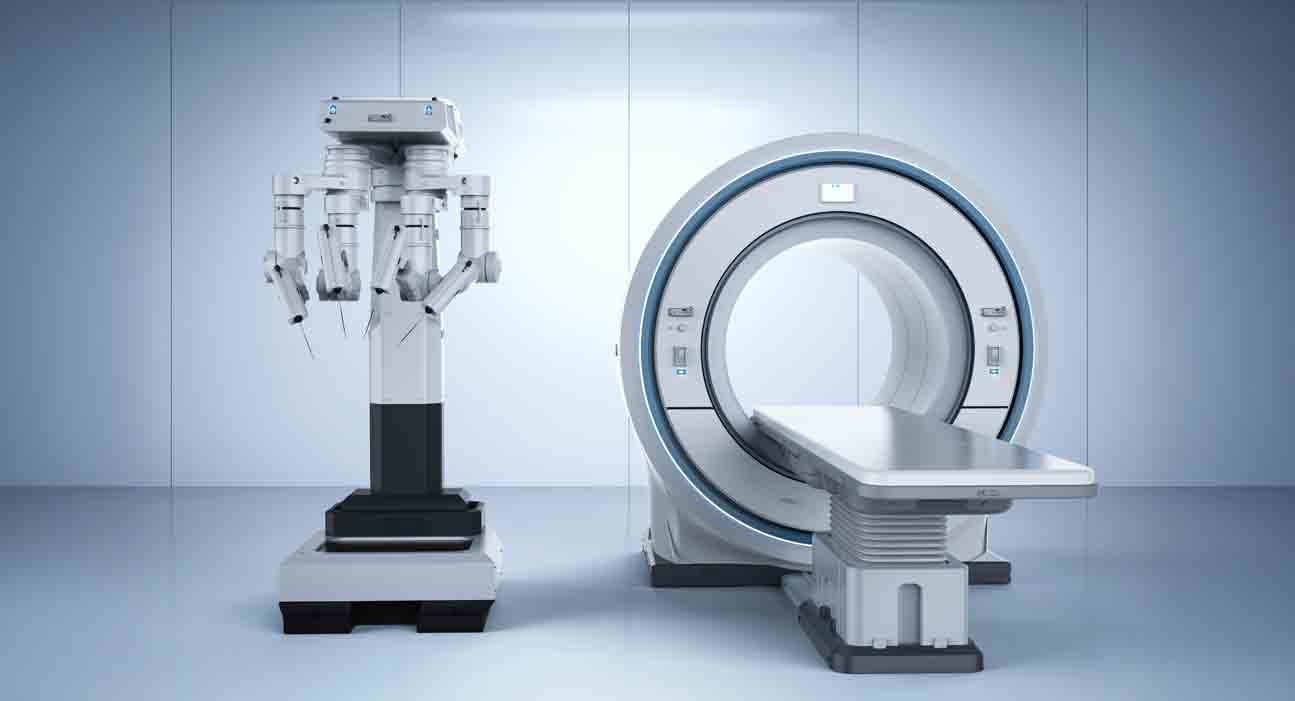

In the calculus of running a Nigerian hospital or clinic, the decision to acquire an MRI machine, a new laboratory analyzer, or portable ultrasound devices is among the most consequential. Too often, this process is driven by immediate clinical need or competitor pressure, leading to a narrow focus on the purchase price. The true cost, and value of medical equipment spans its entire lifecycle: installation, maintenance, staff training, consumables, and eventual decommissioning.

This guide reframes the conversation. We provide hospital administrators, clinical directors, and finance officers with a strategic framework to evaluate, procure, and manage medical technology. The goal is clear: to maximize your Return on Investment (ROI) not just in financial terms, but in enhanced clinical capabilities, staff efficiency, and superior patient outcomes.

Part 1: The Hidden Costs & The True Value Equation

Before seeking quotes, you must understand the full financial landscape.

- The Total Cost of Ownership (TCO): This is your foundational metric. TCO = Purchase Price + Installation + Training + Annual Maintenance & Service + Consumables/Reagents + Utilities + Downtime Costs + Depreciation.

- The Clinical Value Proposition: Financial ROI must be paired with clinical ROI. Will this equipment reduce diagnostic turnaround time? Improve surgical accuracy? Enable new services that attract top specialists? Quantify these where possible.

- The Strategic Alignment Test: Does this acquisition directly support your facility’s 3-5 year strategic plan? Is it for a growing service line? Does it replace aging, unreliable technology that causes clinical risk?

Part 2: The Strategic Procurement Pillar: Buying Smart

The decisions made at the purchasing stage dictate 80% of the lifecycle cost.

- Needs Assessment vs. Wants Analysis: Conduct a formal, multidisciplinary needs assessment involving clinicians, biomedical engineers, and finance. Differentiate “must-have” capabilities from “nice-to-have” features.

- The Vendor Evaluation Matrix: Score potential suppliers on more than price. Include criteria like:

- Local Technical Support: Depth and proximity of service engineers.

- Training Commitment: Comprehensiveness of initial and ongoing staff training programs.

- Warranty & Service Contract Terms: Cost, coverage, and response time guarantees.

- Consumable Cost & Availability: Are reagents/parts proprietary and expensive, or open-market?

- Track Record in Nigeria: Proven performance in similar facilities with comparable power and environmental conditions.

- Financing Exploration: Evaluate all options: outright purchase, leasing, or vendor financing. Leasing can preserve capital and facilitate technology upgrades but may have a higher long-term TCO.

Part 3: The Lifecycle Management Pillar: Optimizing Utilization & Longevity

A machine in the corner, unused or broken, is a financial sinkhole.

- Implement a Computerized Maintenance Management System (CMMS): Move from reactive, paper-based logs to a digital system that schedules preventive maintenance, tracks service history, and manages spare parts inventory. This prevents catastrophic failures.

- Develop a Power & Environmental Resilience Plan: Unstable power is the nemesis of sensitive equipment. Budget for and install appropriate Voltage Stabilizers, Uninterruptible Power Supplies (UPS), and for critical imaging, dedicated power lines. Ensure adequate climate control.

- Maximize Clinical Utilization: Schedule equipment use efficiently. For high-cost imaging, consider extended or staggered shifts. Track usage metrics to identify underutilized assets that could be deployed elsewhere.

Part 4: The Human Capital Pillar: Investing in Expertise

The most advanced machine is useless without skilled operators and maintainers.

- Demand Comprehensive, Structured Training: Vendor training should be mandatory for all user levels. Create “power users” or “clinical champions” on staff who can train peers and troubleshoot basics.

- Build In-House Biomedical Engineering Capacity: Invest in training for your technical staff. Basic troubleshooting and preventive maintenance performed in-house can reduce downtime by weeks and save significant costs.

- Foster a Culture of Ownership: Clinical staff who understand the equipment’s value and cost are more likely to operate it carefully and report issues early.

Part 5: The Data & Analytics Pillar: Measuring to Improve

You cannot manage what you do not measure.

- Track Key Performance Indicators (KPIs): Establish metrics for each major equipment asset: Uptime %, Patient Scan/Tests per Day, Cost per Procedure, Mean Time Between Failures.

- Conduct Regular Clinical & Financial Reviews: Every 6-12 months, review the equipment’s performance against the goals set in the needs assessment. Is it delivering the expected clinical and financial value?

- Plan for Obsolescence & Disposal: Technology evolves. Have a 5-7 year horizon for planning upgrades or replacements. Develop an ethical and compliant plan for disposing of or selling old equipment.

Conclusion: From Cost Center to Strategic Advantage

A strategic, holistic approach to medical equipment transforms it from a daunting capital expense into a powerful engine for growth, quality, and sustainability. It’s about making informed, deliberate choices at every stage of the asset’s life within your facility.

This requires a shift in mindset, robust processes, and—critically—partnerships with suppliers who understand this long-term view and are invested in your success beyond the initial sale.

Partner for Performance, Not Just Purchase

At HQ Healthcare Limited, we guide you through this entire lifecycle. We connect you with leading brands whose technology suits the Nigerian context, negotiate comprehensive service terms, and provide the logistical and support backbone to ensure your investment pays dividends for years to come.

Ready to build a smarter, more sustainable medical technology portfolio?

Schedule a consultation with our medical equipment strategy team to conduct a preliminary audit of your current assets and develop a strategic acquisition roadmap.